Succession Planning

Farm Handover

We're here to help you with the complexities of planning for your farming future.

With over 110 years of farming knowledge and expertise, we know the industry inside and out.

If you’re feeling confused or concerned about some of the proposed changes announced, particularly around Agricultural Property Relief (APR) and Business Property Relief (BPR), we can help you understand what this means for you and how to navigate the complexities.

We know it can be hard to plan for a time when you step back and hand over the reins, especially when there are so many seemingly more immediate concerns.

Our Farm Handover Guide shows there’s lots to think about when it comes to farm succession.

Plan ahead

Whatever your age, it’s never too early to think about the longer-term direction of your farm, and to consider what role you and your family members will play in the years to come.

Starting a conversation about your future farm plans can be challenging. It’s not an easy topic to broach and will likely involve some tricky questions: what is the future of the farm, who will eventually follow in your footsteps and run the business, and how can you all make this work financially?

You’re likely to juggle lots of considerations, from providing financial security for your loved ones to funding your own retirement. You may also plan to sell or let your farmland or property. There’s a lot to think about, and we’re here to help you make sense of the proposed Budget changes, including those around APR/BPR.

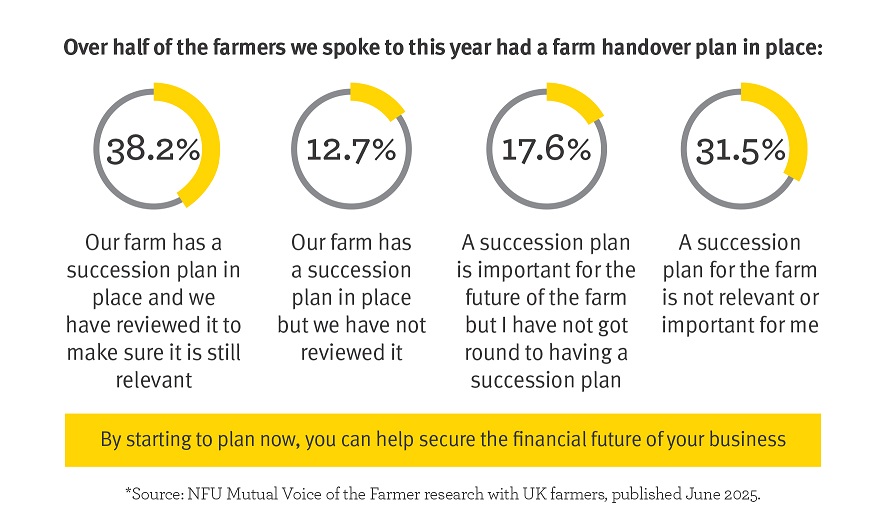

If you feel ill-prepared to tackle this topic, you’re not alone. In a 2025 survey of 1,667 farmers for NFU Mutual*, 17.6% told us they still don't have a formal succession plan in place even though they think it's important to have one. Whilst another 12.7% of farmers have one but they haven't reviewed it recently.

Once you’ve spoken with the relevant professionals such as an accountant or a solicitor and have the right plan for your farming business, NFU Mutual can help you put the right financial plan in place for your own future. An NFU Mutual expert who understands farming can review your financial ideas, and any potential Inheritance Tax traps, to help you put your financial plan into action, so you can get on with running the business.

Regardless of when, or if, you intend to hand your farm on to the next generation, making a personal financial plan is a sensible step to take.

*NFU Mutual Voice of the Farmer research, June 2025

Talk to a financial expert

We can help with your farm handover personal financial plan. By finding out about your unique personal circumstances and financial aspirations, as well as answering all of your questions, we can help to create the right financial plan for your needs. Your farm handover plan will almost certainly mean checking that you have the right pension, investment, and protection arrangements in place. That may include making financial provision for those children who do not wish to be involved in the business. There are a wide range of investment options that can be used as part of the family’s succession plan.

Our philosophy is simple; we listen to what you want and use our expertise to recommend what you need:

- We get to know you

- We listen to your objectives in terms of handing down the farm and your personal financial goals

- We recommend a tailored financial plan just for you, to help you achieve what you want for your family and any successors in your farming business.

You'll benefit from expert advice, so for more information about how we can help you plan your financial future find your local agency office or request a call back.

When you contact us, we’ll explain the advice services we offer and the charges.

Please note that Inheritance Tax advice is not regulated by the Financial Conduct Authority or the Prudential Regulation Authority.

NFU Mutual Financial Advisers advise on NFU Mutual products and selected products from specialist providers.

Financial advice is provided by NFU Mutual Select Investments Limited.