Market fluctuations: what do they mean for your investments?

The past few years have seen significant market fluctuations driven by geo-political and economic events. While at times this can be concerning, market fluctuations are part of investing. By understanding how to navigate these circumstances, long-term financial goals can remain on track.

Understanding market fluctuations and its impact on investments

It can be unsettling to witness the effects of market fluctuations on your investments, especially in light of the recent tariff announcements. You may be wondering what steps to take next.

Firstly, it's crucial to consider market performance over the long-term, as this reveals how markets have historically responded to various economic and event-driven changes.

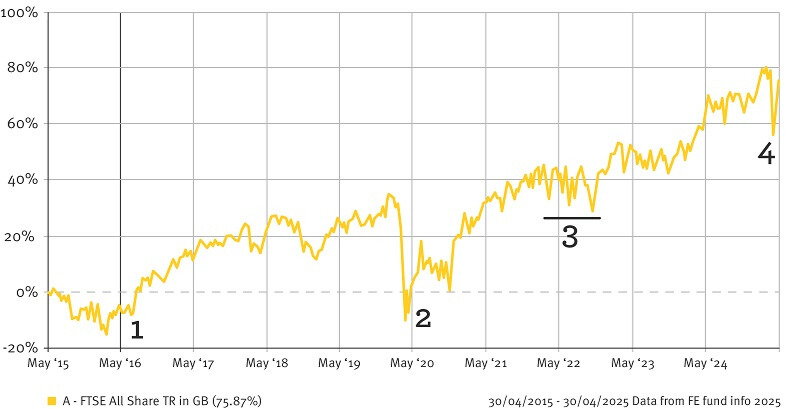

Over the years, there have been numerous market shocks. The graph below highlights several notable events, illustrating their impact on the FTSE All-Share index (which tracks the UK stock market) and the duration it took for markets to recover.

Please remember that past performance is not a reliable indicator of future results. The value of investments and the level of income received from them can fall as well as rise and is not guaranteed. You may not get back the amount of your original investment.

| 30/4/24 to 30/4/25 | 30/4/23 to 30/4/24 | 30/4/22 to 30/4/23 | 30/4/21 to 30/4/22 | 30/4/20 to 30/4/21 | |

| FTSE All Share TR in GB | 7.5 | 7.5 | 6.0 | 8.7 | 26.0 |

1. June 2016 – Brexit Referendum: Uncertainty about future trade and economic relations following the vote for the UK to leave Europe resulted in sharp but short-lived volatility in the markets and sterling devaluation.

2. Mar 2020 – Covid 19 Pandemic: Lockdowns, travel restrictions, and economic disruptions resulted in extended, widespread market uncertainty.

3. Mar 2022 – Invasion of Ukraine / Inflation & Interest Rate Hikes: Russia sent troops across the border to invade Ukraine. Central banks such as the Bank of England implemented aggressive interest rate hikes to curb inflation.

4. Apr 2025 - Trump Tariffs: Sweeping trade tariffs were applied on most global imports to the US including additional reciprocal tariffs for some countries.

Navigating investment decisions during market fluctuations

Investing in the stock market during times of fluctuations and economic uncertainty can feel counterintuitive. However, it's crucial to reflect on the primary reasons for investing. For most, the goal is to achieve long-term financial outcomes, such as retirement or providing for children. Despite current economic turbulence, these long-term plans typically remain unchanged.

While many are understandably focused on the short-term impacts of fluctuations on global markets, it's essential to fully understand how these changes affect your investments. You might consider withdrawing some investments to protect your money from fluctuations or avoid making pension contributions. However, it's important to recognise the potential long-term consequences of these decisions.

Withdrawing your investments during market instability to shelter money in a cash account could result in a less favourable financial outcome in the long run.

- Over time, inflation can erode the purchasing power of cash investments.

- Cash typically offers lower return potential over the long-term, which can prevent you from meeting your financial goals.

- Selling an investment during a market downturn may lock in a loss, even though markets often have the potential to recover over time.

- Some of the most positive days in the market have historically occurred as confidence begins to return—but you’ll miss these if you’re no longer invested.

It’s vital to keep long-term financial goals in mind when making important decisions, and to look beyond market fluctuations, remembering that investment markets are also focused on the long-term.

What should you consider when it comes to investing?

Building an investment portfolio often happens gradually, with each holding chosen for its individual merits. However, a successful investment strategy should start with a plan based on your goals, timeframes, and risk tolerance. This approach helps you create a portfolio tailored to your circumstances and ensures it’s well diversified and balanced.

1. Monthly investments can help manage risk

Investing monthly can help you manage the effects of market fluctuations and potentially maintain progress towards your long-term financial goals. This strategy, known as pound cost averaging, means that when markets fall, your monthly investment buys more units or shares, and when markets rise, you buy less. Over time, this averages out and helps manage share price fluctuations. Investments made when the market is at its lowest will be the most valuable in the event of a market recovery.

What is Pound Cost Averaging?

Pound cost averaging is a straightforward process despite its complex-sounding name. Here’s how it works:

If a company’s share price is £1, a £50 monthly investment buys 50 shares. If the share price drops to 50p, you would buy 100 shares that month. If the share price recovers to £1, the value of your investment grows, giving you more for your money.

However, no investment technique guarantees success. For example, if you’re on a regular investment plan and invest in a fund or share with a price that continues to increase, then over time you’ll get fewer shares for each investment made.

Those small regular investments could help you achieve larger financial goals as small amounts have the potential to grow over time through compounding their own returns.

2. Consider your risk tolerance

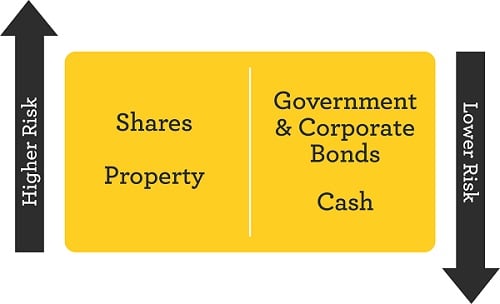

Taking more risk can provide a greater potential for growth over the long-term but is more exposed to market fluctuations.

If you are not sure about your risk appetite and where to invest, we recommend speaking to an NFU Mutual Financial Adviser.

3. Why diversification matters

Spreading your investments across a range of asset types—such as shares, bonds, property, and cash—can help manage risk. Including a mix of company sizes and geographic regions may also contribute to a more balanced portfolio. Different types of investments tend to respond differently to changing market conditions, so having a broad mix can help smooth out some of the ups and downs over time.

4. Time in the market not timing the market

A key concept of investing is to focus on the longer term rather than react to short term uncertainty. This approach is recommended because accurately predicting the optimal moments to invest or withdraw your money is challenging. Remaining invested in markets over extended periods, has in the past, typically delivered long-term growth (5+ years) as investment markets have historically outperformed compared to cash or inflation.

5. The benefits of active fund management

Investing into a managed fund offers the advantage of an investment manager having strategic oversight of how the fund is invested. Unlike passive investing, which will track a specific index, an active manager can tailor the fund allocation to a specific risk tolerance, and market conditions. They continuously monitor the fund to capitalise on opportunities and mitigate risks, ensuring your money is not overly exposed to any single sector.

6. Tax considerations

Certain long-term savings products have the benefit of being tax efficient. They allow the underlying investments to potentially grow without needing to pay UK Income or Capital Gains Tax on any growth.

These include:

Pensions

- With personal pension contributions (those not from an employer), for every £80 you invest the government will add £20. If you pay 40%- or 45%-Income Tax, you can reclaim additional tax relief directly from HMRC.

- When taking pension benefits, you can normally take up to 25% of your pension fund as a tax-free lump sum* when you take it, with the remaining 75% taxable at the owner’s Income Tax rate.

*In most cases, the maximum tax-free cash you can take across all your pensions is £268,275 unless you have registered for protection.

ISAs

- ISAs offer a tax-efficient way to invest and potentially grow your investments. While generally any growth and withdrawals are free from UK Income and Capital Gains Tax, certain taxes, such as Inheritance Tax, may still apply to the value of your ISA upon death.

- The current ISA contribution limit is £20,000 per tax year (April 6, 2025, to April 5 2026). This means you can contribute up to this amount across all your ISA accounts each year.

The tax treatment of ISAs and pensions depends on individual circumstances and may change in the future.

You should be aware that the value of investments can rise or fall, and you may get back less than invested.

NFU Mutual Financial Advisers advise on NFU Mutual products and selected products from specialist providers. When you contact us, we'll explain the advice services we offer and the charges. Financial advice is provided by NFU Mutual Select Investments Ltd.

Looking for financial advice?

If you’re not sure how to put your financial plan in place, one of our NFU Mutual Financial Advisers can help. They'll be able to recommend products that are right for you based upon your personal circumstances. You can book an appointment with an NFU Mutual Financial Adviser by either calling: 0800 622 323 or requesting a call back.